BEST STOCKS TO BUY TODAY: IAU @03/13/2023

| Ticker | IAU, Financial | Note |

| Last Price | 36.29 | |

| Buy | 36.29 | Limit Order This is generated by our mechanical trading system. Please read the chart section for more detailed and flexible entry options. |

| Target | 39.92 | Default at 10%, Or Sell when close below ma5(short term)/10(midterm)/20(long term) or when big down day or when formed inverted hammer at a resistance level |

| Stop | 34.75 | |

| Reward/Risk | 2.36 : 1 |

Above is the summary of one of our Best Stocks To buy.

More Technical Status

| ATR | 0.41 | |

| Beta | – | |

| RSI(14) | 65.30 | |

| SMA20 | 4.20% | Distance to SMA20 |

| SMA50 | 2.41% | Distance to SMA50 |

| Recommendation | – | Analysts’ mean recommendation (1=Buy 5=Sell) |

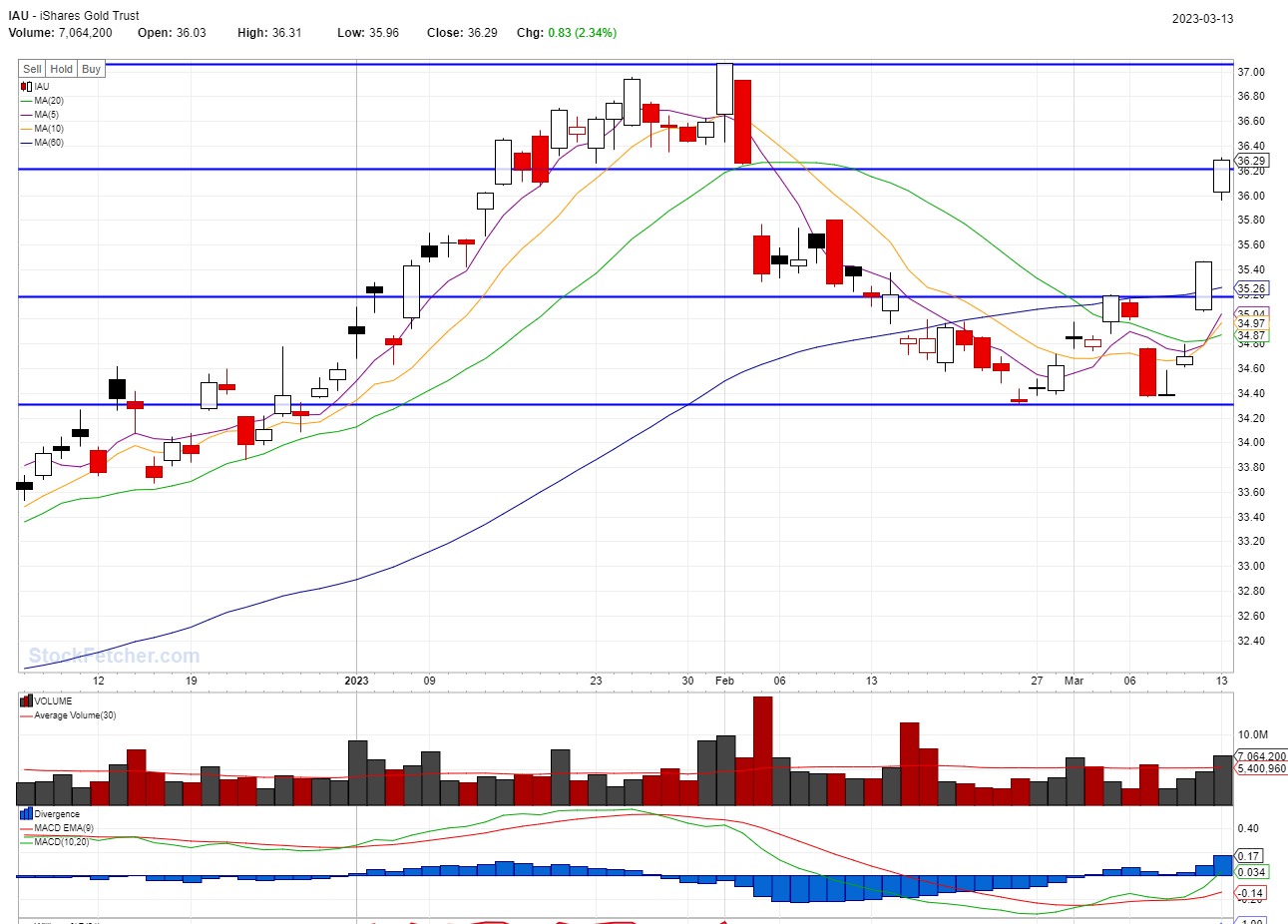

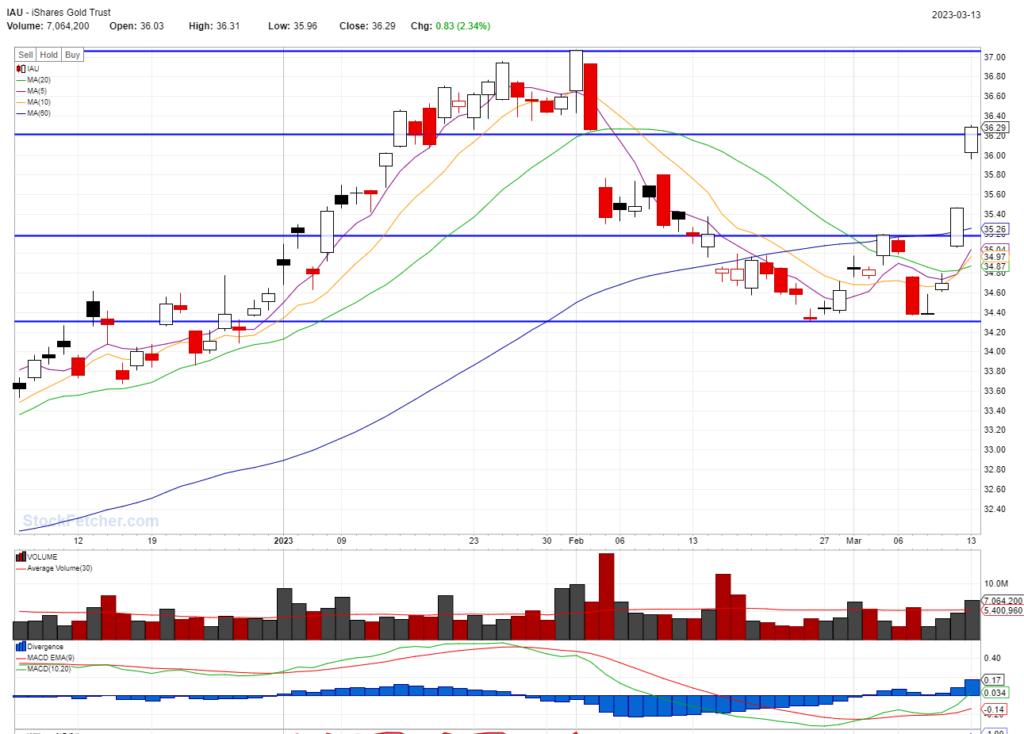

Our system generated several buy signals today. IAU is one of them. Let’s take a look at this stock’s chart.

Gold has made a huge move in last few days. We should see it test $37 level shortly. There are many other gold ETF too that you can user as alternative to IAU, another very popular one is GLD.

More info about GLD and IAU

ETFs GLD and IAU are both investment vehicles that provide exposure to gold, a precious metal that is often used as a store of value and a hedge against inflation. Here are some key points to consider when thinking about investing in these ETFs:

- What are ETFs?

ETFs, or exchange-traded funds, are investment funds that are traded on stock exchanges like individual stocks. They are designed to track the performance of a particular index, asset class, or sector, and offer investors an easy way to gain exposure to a diversified portfolio of securities with lower fees and greater flexibility than traditional mutual funds.

- What is GLD?

GLD is an ETF that tracks the price of gold bullion, and is the largest and most popular gold ETF. Each share of GLD represents a fraction of an ounce of physical gold, and the ETF holds gold bars in secure vaults around the world.

- What is IAU?

IAU is another ETF that tracks the price of gold bullion, and is the second largest gold ETF. Like GLD, each share of IAU represents a fraction of an ounce of physical gold, and the ETF holds gold bars in secure vaults.

- What are the differences between GLD and IAU?

While both GLD and IAU track the price of gold bullion, there are some differences between the two ETFs that investors should be aware of. For example:

- Expense ratio: GLD has a slightly higher expense ratio than IAU (0.40% vs. 0.25%).

- Liquidity: GLD is more liquid than IAU, meaning that it may be easier to buy and sell shares of GLD than shares of IAU.

- Size: GLD is larger than IAU in terms of assets under management.

- Ownership structure: GLD is structured as a trust, while IAU is structured as a grantor trust. This difference can have tax implications for investors.

- What are the risks and benefits of investing in gold ETFs?

Investing in gold ETFs like GLD and IAU can provide several potential benefits, such as:

- Diversification: Gold can serve as a hedge against inflation and market volatility, and can help to diversify a portfolio that is heavily invested in stocks or bonds.

- Convenience: Gold ETFs provide a convenient way to invest in gold without the need to purchase physical gold and store it securely.

- Transparency: Gold ETFs provide real-time price information and are subject to SEC reporting requirements, which can help investors make informed investment decisions.

However, investing in gold ETFs also carries some risks, such as:

- Volatility: Like any investment, the price of gold can be volatile and can fluctuate rapidly in response to market conditions and other factors.

- Fees: Gold ETFs charge management fees and other expenses, which can reduce investors’ returns over time.

- Counterparty risk: While gold ETFs hold physical gold in secure vaults, investors still face some counterparty risk in the form of the ETF’s custodian and other service providers.

- How should investors decide between GLD and IAU?

Ultimately, the decision of whether to invest in GLD or IAU (or another gold ETF) will depend on an investor’s individual needs and preferences. Factors to consider might include the size of the investment, the investor’s risk tolerance, and the relative costs and liquidity of each ETF. Consulting with a financial advisor can also help investors make an informed decision.