BEST STOCKS TO BUY TODAY: QQQ @03/16/2023

| Ticker | QQQ, Financial | Note |

| Last Price | 306.81 | |

| Buy | 306.81 | Limit Order This is generated by our mechanical trading system. Please read the chart section for more detailed and flexible entry options. |

| Target | 337.49 | Default at 10%, Or Sell when close below ma5(short term)/10(midterm)/20(long term) or when big down day or when formed inverted hammer at a resistance level |

| Stop | 292.95 | |

| Reward/Risk | 2.21 : 1 |

Above is the summary of one of our Best Stocks To buy.

More Technical Status

| ATR | 6.46 | |

| Beta | – | |

| RSI(14) | 61.10 | |

| SMA20 | 3.57% | Distance to SMA20 |

| SMA50 | 5.27% | Distance to SMA50 |

| Recommendation | – | Analysts’ mean recommendation (1=Buy 5=Sell) |

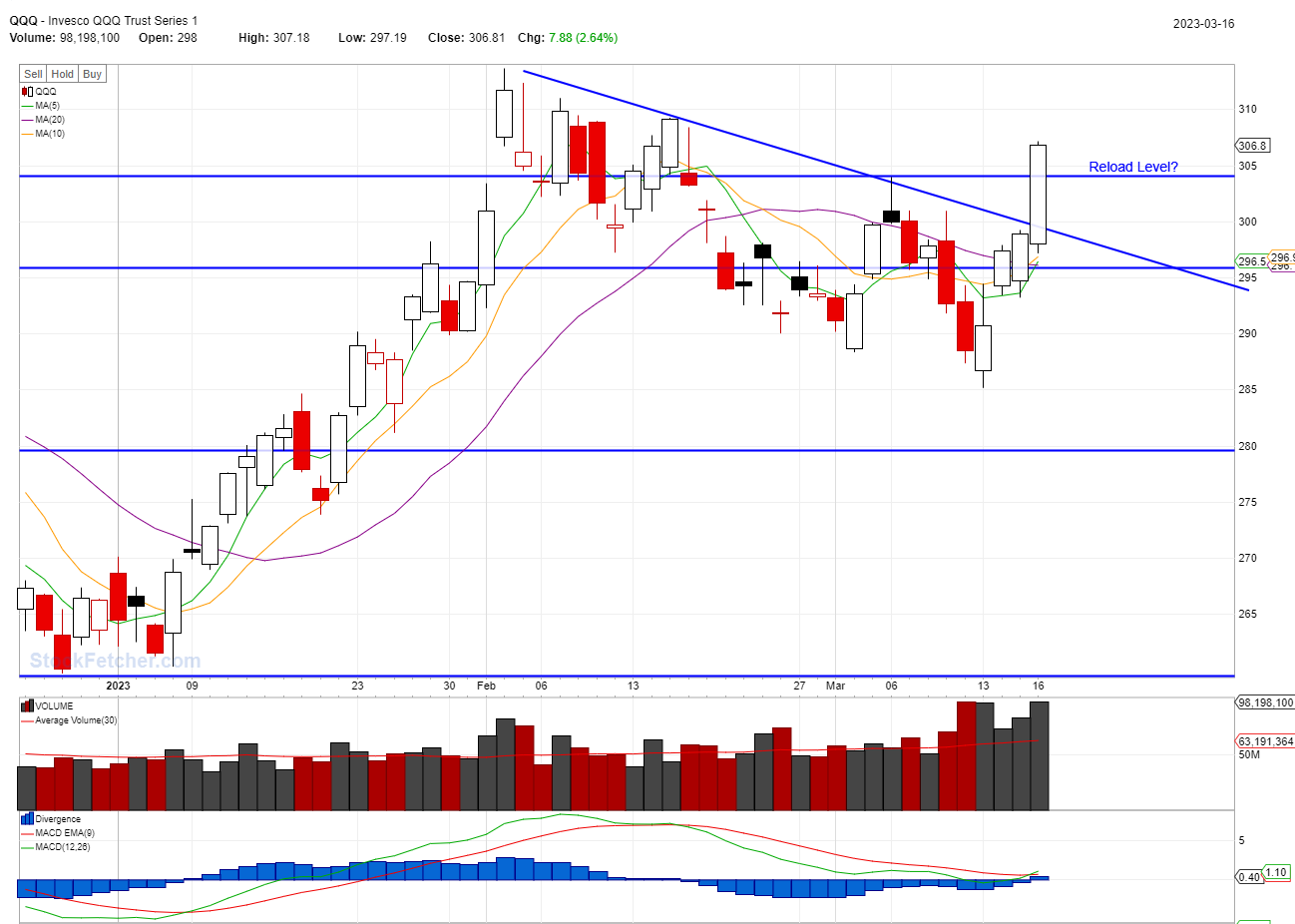

Our system generated several buy signals today. QQQ is one of them. Let’s take a look at this stock’s chart.

QQQ made a huge pop today and it breaks previous high, so technically, it made a higher high. But We don’t see a lower low in place yet, which means it most likely will re-test previous high. If it holds, then it is a great place to reload QQQ around $302 or even $300 level.

More info about QQQ ETF

QQQ refers to the Invesco QQQ Trust, which is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index. The Nasdaq-100 Index is made up of the 100 largest non-financial companies listed on the Nasdaq stock exchange.

The QQQ ETF is widely considered to be a benchmark for technology stocks, as the Nasdaq-100 Index is heavily weighted towards technology companies. Some of the largest holdings in the QQQ ETF include tech giants like Apple, Microsoft, Amazon, Facebook, and Alphabet (Google).

Investors can buy and sell shares of the QQQ ETF on stock exchanges just like individual stocks. The performance of the QQQ ETF is influenced by the performance of the underlying companies in the Nasdaq-100 Index. As such, it can be a good option for investors looking to gain exposure to the tech sector or to diversify their portfolio with a broader range of large-cap stocks.

For trades like to take leverage ETF, we can also use TQQQ which is 3X QQQ.

The following is the chart of TQQQ. The chart looks very similar as QQQ, however, a few things we need to be careful. TQQQ/QQQ made a huge gain today, but the volume does not spike. So the down trend line breaks out is still questionable. Most likely it will reset $24 or even $23 level, If it holds, then it means that is a true break out and it most likely will make a new high. If it falls back down $23 level in next a few days, it will be a short entry point.

More info about TQQQ:

TQQQ is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index with a leveraged factor of 3x, which means it aims to provide three times the daily return of the underlying index. The ticker symbol “TQQQ” stands for “ProShares UltraPro QQQ.”

Investors who purchase shares of TQQQ are essentially making a leveraged bet on the performance of the Nasdaq-100 Index. While leveraged ETFs like TQQQ can offer the potential for higher returns, they also come with increased risk due to their leveraged exposure, and they are generally recommended for short-term trading or as a hedging tool for experienced investors.

It’s important to note that the leveraged nature of TQQQ means that its returns can deviate significantly from the underlying index over longer periods, especially during volatile market conditions. Therefore, it’s crucial for investors to fully understand the risks associated with leveraged ETFs and to have a solid understanding of their investment objectives and risk tolerance before investing in TQQQ or any other leveraged ETF.